Disclaimer: At no time can any employee of the Hall County Tax Commissioner provide legal advice. If questions about processes or legal rights arise regarding property involved in a tax lien, levy, or tax sale, we recommend seeking legal advice. If interested in purchasing a property at a tax sale, we strongly encourage seeking professional advice before participating in the sale.

The Tax Commissioner generally only holds sales in a few selected months throughout the year. Whenever the Tax Commissioner’s Office warrants a tax sale, the date, time and location can be found below (4 weeks prior to tax sale date), in addition to any Bank | Auction advertisement below.

E Prospective Purchaser’s Guide

All tax sales are a BIDDER BEWARE sale. The attached guide is designed to answer questions and provide an insight into the legal framework that gives the Hall County Tax Commissioner the authority to conduct a real-estate tax sale in the State of Georgia. The guide is available HERE.

E Delinquent Tax- Prior to Tax Sale

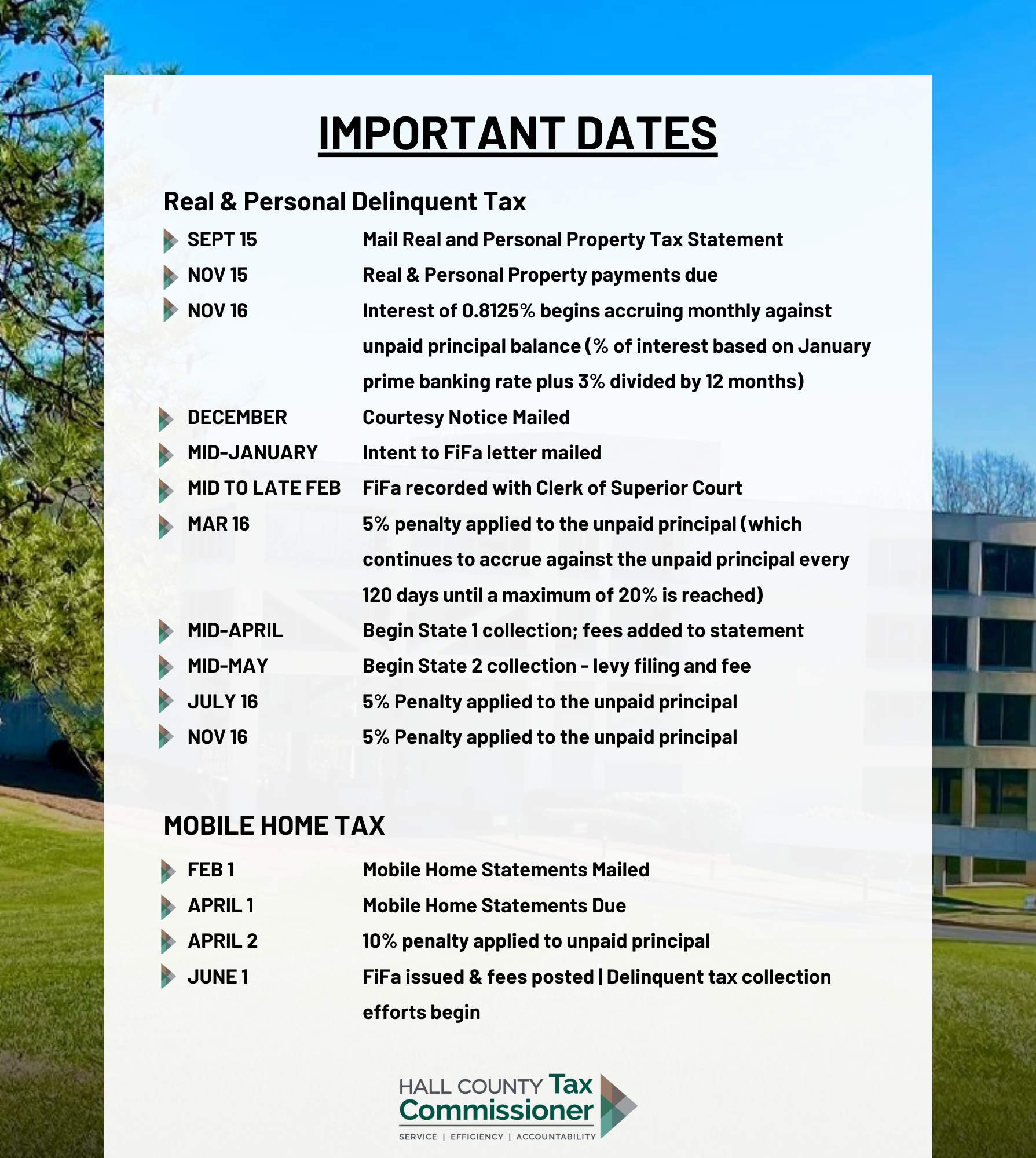

All tax remaining unpaid after the due date is delinquent and subject to interest and penalties as mandated by state law.

If payment is late, the following state-mandated interest and penalty will be added to the balance owed:

- An annual interest of the annual prime banking rate plus 3% will be added on the unpaid principal balance due. The 2026 monthly interest rate is 0.8125%.

- A five percent (5%) penalty will be added to the unpaid principal 120 days from the due date. An additional 5% penalty (on the unpaid principal) will accrue every 120 days until a maximum of 20% of the original principal has been charged.

If remaining balance is not paid in full, a FiFa (tax lien) may be issued against the property and the owner of record as of January 1. For real property, if the owner on January 1 can provide proof of the transfer of ownership and transfer of tax liability to a new owner within 90 days from the due date, the FiFa will be issued in the name of the owner. Once a FiFa has been issued, the property is subject to levy and sale at a tax auction.

When a property has been selected for to tax sale, additional costs in the form of fees are added to the amount due for title research, advertising and other necessary actions.

E Tax Sale

A current tax sale list, if scheduled, can be found in the Gainesville Times’ Legals section every Weekend and Wednesday for four weeks prior to the sale. A current tax sale list is also available HERE.

The Hall County Tax Commissioner follows legal procedures prescribed by the Official Code of Georgia Annotated (OCGA) when levying property. We strongly suggest reading those sections of Georgia law which pertain to tax executions and tax sales. OCGA 48-3 and 48-4, contain important information that residents must be aware of.

Tax sales are held on the first Tuesday of each month (for months in which a tax sale is planned), at 10 AM. Arrive early to fill out a bidder registration form prior to the tax sale. Bidders or a representative must be present to bid. Mail, phone or faxed bids are not acceptable.

The opening bid for a property is the amount of tax due, plus penalties and all other applicable fees. The Sheriff’s Tax Deed, not the property, is sold to the highest bidder. Payment is due in full by 1 PM on the day of the tax sale. Only certified funds are accepted in the form of cash, cashier’s check, or money order. Buying property without payment is subject to legal ramifications.

E After the Sale

Though the tax sale purchaser receives a sheriff’s tax deed for the property, possession of, improvements to, and/or eviction of any tenants on the property, are not allowed immediately by the purchaser.

Georgia law allows the property owner or anyone with any right, title or interest in the property to repurchase (redeem) the Tax Deed. Until the right of redemption has been foreclosed, a sheriff’s tax deed has about the same equivalent as a lien.

E Right of Redemption

When real property is sold at a tax sale, the owner, creditor or any person having an interest in the property may redeem the property from the holder of the tax deed within 12 months from the original tax sale date. The redemption price may include the purchaser’s bid amount, taxes paid by the purchaser after the tax sale, any special assessments on the property, plus 20% premium. The tax sale purchaser is responsible for determining the amount payable for redemption. Redemption of the property puts the title conveyed by the tax sale back to the owner of record and is subject to all liens that existed at the time of the tax sale. Hall County does not assist in the redemption or foreclosure process.

E Notice of Foreclosure of Right to Redeem

After 12 months from the date of the tax sale, the purchaser at the tax sale may terminate or foreclose on the owner’s right to redeem the property. To foreclose on the right of redemption, notice must be sent via certified mail to the owner of record and to all interest holders which appear on the public record. In addition, the notice of foreclosure is required to be published in the newspaper in the county in which the property is located once a week for four consecutive weeks.

E Right of Redemption Foreclosed

After foreclosing the right of redemption, it is recommended that the purchaser seek legal advice regarding the petition to quiet title in land, pursuant to O.C.G.A.§ 23-3-60.

Under the action, the petitioner (tax deed purchaser) makes a request to the court to take jurisdiction over the matter. The court then appoints a Special Master (third party) to examine the petition and exhibits to determine who is entitled to notice. The petitioner will then ask the court to issue a decree establishing his/her title in the land against “all the world” and that all “clouds to petitioner’s title to the land be removed” and that said decree be recorded as provided by law.

E What To Know The Day Of